Discover U.S. private islands for sale. Prices, legal rules, financing, and expert tips on buying your own island paradise in America.

By a researcher compiling market data, legal and environmental guidance, and buyer-proven checklists from leading island brokers and government agencies. This article synthesizes market listings, regulatory guidance, and practical experience distilled into step-by-step advice for anyone considering buying a private island in the U.S.

1) Market overview — Where private islands in the U.S. are, and who sells them

The United States spans temperate rocky coasts, Great Lakes islands, southern barrier islands and Florida Keys — meaning offers range from rustic lake islands to high-priced coastal retreats. The majority of private-island inventory available to buyers is concentrated along the eastern seaboard (Maine, New York’s Thousand Islands region, and Florida), but you’ll also find pockets of inventory in Washington state, the Great Lakes, Minnesota, and Alaska. Specialist portals and brokers maintain the bulk of listings and market intelligence. (privateislandsonline.com)

Two types of sellers dominate the market:

- Island-specialist brokers (Vladi Private Islands, PrivateIslandsOnline, Private Islands Inc.) who list islands worldwide and handle high-end transactions. (vladi-private-islands.de)

- Local brokers and MLS/land marketplaces that list smaller or regionally focused properties (e.g., LandSearch, local brokerages for Maine or San Juan Islands). (LandSearch)

2) Types of islands and price ranges — what to expect to pay

Common island types

- Coastal barrier islands / nearshore islands: sandy beaches, dunes, often in Florida, Texas, the Carolinas, parts of the Gulf Coast. These come with significant coastal regulation and flood exposure.

- Rocky Atlantic islands (Maine, New England): smaller, rocky, often with lobster-fishing heritage or rustic cabins.

- Thousand Islands / inland-river islands (New York, St. Lawrence, Great Lakes): popular for cottage compounds and historic houses.

- Inland-lake islands (Minnesota, Wisconsin, Michigan): often lower price points, used for cabins and retreats.

- Pacific Northwest & San Juan Islands (Washington): forested islands with temperate climates and strong maritime culture.

- Alaska islands: remote, wild — very different logistic profile and costs. (privateislandsonline.com)

Price ranges (broad guide)

Prices are wide. Recent market surveys and guides show:

- Entry-level: some undeveloped inland islands can list under $100k–$500k (rare, often very small or with restricted access).

- Mid-market: many U.S. islands (small coastal or lake islands with limited infrastructure) fall in $500k–$3M.

- High-end: developed coastal islands and island compounds range from $3M–$30M+, with trophy islands above that. Recent U.S. listings include multi-million-dollar Connecticut and Greenwich islands and other coastal examples. Market guides also note islands listed as low as tens of thousands and as high as many millions — the distribution is broad. (Wise)

(Practical note: an asking price is only part of the cost. Development, insurance, utilities, access, and annual maintenance will be material and sometimes greater than the purchase price over time — we’ll unpack these later.)

3) Where to look and how transactions usually happen

Primary sources for listings

- Specialist island brokerages and portals: Vladi Private Islands and PrivateIslandsOnline are the marketplace leaders and archives of past sales. They publish property details and buyer guides. These are the first stops for serious buyers. (vladi-private-islands.de)

- Regional real estate sites / MLS / land marketplaces: for state-level inventory (LandSearch and local MLS for Maine, Washington, etc.). (LandSearch)

- Auctions and private sales: occasionally islands are sold via auction or private off-market deals; specialist brokers will often know of off-market opportunities.

How deals are usually structured

- Transactions in the U.S. are similar to other high-value real estate sales: an offer, inspections, title search, financing (if used), and closing. Because islands are specialty real estate, buyers typically retain specialty advisors: marine surveyors, coastal engineers, environmental consultants, and island-experienced title companies or attorneys. Specialist brokers often coordinate these services for buyers. (privateislandsonline.com)

4) Key legal & regulatory considerations (must-read for every buyer)

Buying an island in the U.S. is not just a real estate transaction — it almost always involves a patchwork of local, state, and federal rules. Here are the most important legal axes to check:

4.1 Ownership structure and foreign buyers

- In the U.S. private islands can be bought freehold; generally there are no special federal rules preventing foreign ownership of private land. However, screening laws and specific security considerations can apply near ports or military areas. Specialist brokers note that most islands on the market are sold freehold. Always check state-level restrictions and any local filings required. (privateislandsonline.com)

4.2 Coastal regulation and federal-state interplay

- Coastal Zone Management Act (CZMA): a federal law that sets a framework and funds state-level coastal management programs. NOAA’s Office for Coastal Management coordinates with states—many coastal states have permitting systems and rules about shoreline modification, vegetation removal, docks, and development density. This can materially restrict what you can build on a coastal island. You must consult the state’s coastal management office for the specific island location. (NOAA Coastal Management)

4.3 Wetlands, tidal lands, and public trust doctrine

- Tidal lands, intertidal areas and certain wetlands are often under state ownership or subject to public trust — meaning you may own the upland parcel but not the foreshore or submerged lands. Access, dock placement, and shore-hardening (seawalls) are governed tightly in many states. Always obtain a survey and confirm the mean high tide line and any public access corridors. Local permitting offices will confirm boundaries and permitted uses.

4.4 Flood zones, FEMA maps, and insurance

- Most coastal islands fall into FEMA’s flood map framework. FEMA’s Flood Insurance Rate Maps (FIRMs) and National Flood Hazard Layer identify Special Flood Hazard Areas (SFHA), including VE/AE zones with high risk and potential requirement for flood insurance if you have a federally-backed mortgage. FEMA mapping tools and guidance are essential to understanding baseline requirements (e.g., building elevation, base flood elevations). Expect stricter building codes and mandatory flood insurance when the property lies in SFHA zones. (FEMA)

4.5 Endangered species, migratory bird protections, and habitat rules

- Islands—especially barrier islands and small coastal islets—are often home to nesting birds, shorebirds, or rare plant communities. Federal laws (MBTA, Endangered Species Act) and state conservation rules can restrict development (seasonal work windows, protected areas). If the island is habitat for protected species, mitigation and avoidance may be required. An early-phase environmental assessment is critical.

4.6 Title, easements, and rights-of-way

- Common title issues on islands: tidal/granted rights to the water, historic easements (ferry rights), utility easements across nearby properties, and unresolved boundary lines. Use a title company experienced in coastal/island work. Also check for any conservation easements or deed restrictions — they can be voluntary tax-driven encumbrances or state-imposed restrictions. The IRS and land trust organizations provide guidance on conservation easements — both as legal constraints and potential tax planning tools. (IRS)

5) Practical logistics — access, utilities, waste, and communications

Islands are special-purpose properties. Whether you want a weekend cabin or a fully serviced retreat determines the level of investment required.

5.1 Access & transport

- Boat access: The most common; check depth charts, availability of sheltered moorings, and whether deep-water docks are present or permitted. If no dock exists, adding one will likely require an Army Corps/State permit.

- Bridge/road access: A minority of islands are connected by causeway or bridge (and close inshore islands sometimes have bridges). Ownership and maintenance obligations for a bridge can be significant. Example: Farwells Island in Greenwich is connected by bridge — a very different ownership profile from a boat-only island. (CT Insider)

- Air access: Some remote islands support seaplane or helicopter access — but adding a helipad or airstrip has permitting and insurance implications.

5.2 Power

- Options include: on-grid power (if a cable exists), local generators, propane, or off-grid renewable systems (solar + battery). Undersea power cable installation is expensive and heavily permitted. For many buyers, a hybrid solution (solar + generator) is the cost-effective starting point. For long-term luxury islands with heavy loads, grid extension—or high-capacity backup generators—become significant capital items. Guidance and technical specs should be obtained from marine electrical engineers. (privateislandsonline.com)

5.3 Water and septic

- Freshwater: Options: drilled well (if geology permits), rainwater harvesting + filtration, or cisterns supplied by barge. Some small islands rely solely on hauled water delivered by boat.

- Septic/waste: On-site septic systems need appropriate soils and percolation capacity; on rocky islands you may need engineered systems (mound systems, marine-rated septic). Closed-loop composting systems are used on remote sites. Early geotechnical and soils testing is mandatory. (privateislandsonline.com)

5.4 Communications & emergency services

- Satellite internet or fixed wireless are common choices. Confirm cellular coverage (often poor) and emergency response arrangements (which agency covers the island? Coast Guard? Local EMS?). Plan emergency evacuation logistics and medevac access as part of operational planning.

6) Financing, taxes, insurance and conservation incentives

6.1 Financing

- Island purchases often require all-cash buyers or specialty lenders. Traditional banks will sometimes lend on island properties but often at higher down payments and stricter underwriting due to insurance and access risk. Specialist marine/mansion lenders or private lenders are common. Expect a larger down payment and proof of insurance availability as conditions for lending.

6.2 Property taxes

- Islands are assessed by local tax jurisdictions; taxes vary widely depending on improvements and local mill rates. Beachfront or “luxury” islands near wealthy towns (Greenwich, CT; certain Florida Keys islands) can carry high property tax bills comparable to mainland estates. Always check historical tax records and potential for reassessment after purchase/renovation.

6.3 Insurance

- Insurance for coastal islands is often the single biggest annual cost. Policies often combine homeowner, windstorm/hurricane (depending on region), flood insurance (if in SFHA), and marine liability for docks. Insurers will require mitigation steps (elevated construction, hurricane shutters, certified dock design). Availability and premium depend on FEMA zone, local building codes, and historical claims in the county. Work with an insurer experienced in coastal properties. (FEMA)

6.4 Conservation easements and tax strategies

- Voluntarily granting a conservation easement to a qualified land trust or government entity can reduce estate and income taxes in exchange for restricting development rights. The IRS recognizes conservation easement deductions (with specific rules and scrutiny), and land trust alliances provide resources on estate tax incentives for protected lands. This can be an effective tool for buyers who want to protect natural features while achieving a tax strategy — but it permanently encumbers the property. Consult estate and tax counsel before considering an easement. (IRS)

Read this also: Where Does Dwayne Johnson “The Rock” Live in 2025? Inside His Beverly Hills Mansion, Virginia Farm & Past Homes

7) Due diligence checklist — essential inspections, documents and steps

Below is an actionable due-diligence checklist you can hand to your broker/attorney. Treat each item as indispensable.

Title & legal

- Full title search (including chain of title, mortgages, liens, mechanic’s liens).

- Survey showing lot lines, mean high water line, easements, rights-of-way, and deeded access.

- Check for conservation easements, covenants, and deed restrictions.

Regulatory & environmental

- FEMA Flood Insurance Rate Map (FIRM) determination and base flood elevation (BFE). Request FIRMette and NFHL print. (FEMA)

- State and local coastal zone management consistency review; determine required permits (dock, seawall, building). (NOAA Coastal Management)

- Wetlands delineation and jurisdictional determination (Army Corps/state wetlands).

- Endangered species survey and consultation history (if any).

- Historic designations that may restrict changes.

Physical & infrastructure

- Full topographic and bathymetric survey (shoreline, underwater depths).

- Soil and percolation tests for septic; geotechnical report for foundations.

- Utility availability assessment (power cable on seabed, water well potential, cell coverage).

- Structural inspection of existing buildings, docks, boathouses. Marine engineer check for dock condition.

Operational

- Review of past insurance claims and current policies.

- Review of annual maintenance records and current staffing (if operated as lodge).

- Confirm emergency response coverage (which agency responds and approximate response time).

Financial & tax

- Current property tax history and tax assessment details.

- If financing will be used: pre-approval or evidence of lender willingness.

- Determine local special assessments or HOA fees (if any).

Other practical checks

- Confirm navigation/channel markers and shoaling history for safe access.

- If ferry or service access is common (e.g., for guests), obtain copies of service agreements.

- If the island was used commercially (lodge, rentals), request occupancy and revenue history.

(Many specialist brokers include a buyer’s packet with many of these items; insist on seeing documentation before committing to an inspection period.) (privateislandsonline.com)

8) Negotiation, closing, and post-close operations

Negotiation tips

- Leverage documented constraints. If permits for a dock or expansion are uncertain, use that as a negotiating point to lower price or require seller to secure pre-approvals.

- Ask for recent environmental & title documentation as contingencies in the purchase contract. If seller cannot produce clear surveys or permit history, require escrow for remediation or a price reduction.

- Structure earnest money and inspection contingencies to protect you while you evaluate remote-site logistics (one of the big surprises is unexpected costs to bring utilities). Specialist brokers can help craft island-specific contingencies.

Closing

- Use a title company and closing attorney with coastal experience. Ensure title insurance includes coverage for tidal boundaries and title defects specific to shoreline property.

- For cross-border or foreign buyers: wire transfers for large sums must follow bank compliance and AML procedures — plan for extended lead times.

Post-close operations & maintenance

- Plan for YEAR-ROUND or seasonal staffing (caretaker, dock master, maintenance). Many owners contract a local manager or island-services company for routine upkeep.

- Establish regular environmental monitoring (shoreline erosion, invasive species), and implement a hurricane/flood plan if in an at-risk coastal zone.

- Budget for annual dredging or dock repairs if the access channel shoals. These maintenance costs are recurring and can be large.

9) Case studies & sample budgets (illustrative)

Below are condensed, illustrative examples to help you visualize the total cost of ownership. These are examples — every island differs.

Case A — Small inland lake island (Midwest) — purchase price: $475,000

- Purchase: $475,000

- Closing costs & transfer taxes: ~$10k–$15k

- Initial access/improvements: dock + mooring, hauled water, small solar + generator — $35k–$75k

- Septic installation (if needed): $10k–$25k

- Annual taxes & insurance: $2k–$5k/year

- Annual maintenance & caretaker: $6k–$12k/year

Why cheaper: freshwater, lower insurance costs, simpler permitting. (LandSearch)

Case B — Mid-Atlantic coastal island (owner wants compound) — purchase price: $3.5M

- Purchase: $3.5M

- Survey, environmental & permitting (dock, seawall, septic): $50k–$200k (permits can require mitigation)

- Utilities: grid extension expensive; expect $200k–$1M depending on cable distance — otherwise high-capacity generator + solar $150k–$400k.

- Flood insurance & wind/hurricane insurance: $15k–$60k/year depending on zone and building standards.

- Annual maintenance & property management: $30k–$100k/year.

Why expensive: coastal regulation, flood risk, higher construction and insurance costs. FEMA maps and state permits drive design. (FEMA)

Case C — Luxury coastal island compound (Northeast; trophy property) — purchase price: $22M (example: Farwells Island listing)

- Purchase: $22M (example based on an actual Greenwich listing).

- Significant pre-existing improvements (main house, guest house, docks) reduce immediate capex but maintain very high insurance and taxes.

- Annual taxes, staff, and high-end maintenance easily $200k+/year depending on staff & utilities. (CT Insider)

10) Environmental & resilience planning — building for the future

Buying an island in 2025 means factoring in sea-level rise, increasing storm intensity, and coastal erosion. Two practical, evidence-based steps:

- Design for elevation & resilience: build on pilings or elevated foundations to meet or exceed base flood elevation (BFE) standards. Use flood-compatible materials, breakaway walls where appropriate, and utilities elevated above flood levels. FEMA guidance and local codes will drive minimums. (FEMA)

- Natural shoreline solutions: where permitted, favor living shorelines (plantings, marsh restoration) over hard armoring (seawalls), both for regulatory and ecological reasons. Federal and state coastal programs favor nature-based solutions in many contexts. Consult NOAA coastal resources for best practices. (NOAA Coastal Management)

11) Pros & cons — candid view for a buyer

Pros:

- Unmatched privacy and control over your own micro-ecosystem.

- Potential for unique revenue models (exclusive rentals, events, eco-tourism) if permitted.

- Conservation & legacy potential using easements or trusts.

Cons / common surprises:

- Hidden and recurring costs (insurance and maintenance).

- Permitting constraints that limit expansion or repairs (docks, seawalls).

- Access and logistics complexity (supply runs, staff, emergency response).

- Environmental exposure (storms, erosion, sea-level rise).

12) Quick decision checklist for a first visit (what to bring & ask on day one)

If you go to inspect an island for the first time, bring this quick kit:

- Detailed questions for the listing agent: permit history, year of last major renovation, insurance claims, dredging history, access channel notes.

- Request: latest title report, survey, FEMA map/zone, and any environmental studies.

- On-site: check docking conditions at high/low tide, shoreline erosion signs, and the condition of access routes.

- Bring: a marine GPS app or chart for bathymetry, an anemometer if you want to measure local winds, and a camera for documentation.

13) Recommended reading & primary resources (start here)

- Vladi Private Islands — global specialist with archives and listings. (vladi-private-islands.de)

- PrivateIslandsOnline — U.S. and worldwide listings plus a buyer’s guide. (privateislandsonline.com)

- FEMA Flood Maps and Coastal Flood Risk guidance (use NFHL viewer). Essential for assessing FEMA zone & insurance implications. (FEMA)

- NOAA Office for Coastal Management — Coastal Zone Management Act guidance and state program links. Use for permitting context. (NOAA Coastal Management)

- Wise guide: “How much does a private island cost?” — helpful market primer on price ranges. (Wise)

- IRS and Land Trust Alliance materials for conservation easement and estate tax guidance. (IRS)

14) Final, pragmatic buying roadmap (step-by-step)

- Define goals — weekend cabin vs. revenue property vs. legacy conservation. This determines budget and permissible uses.

- Find inventory — use specialists (Vladi / PrivateIslandsOnline) + local MLS where appropriate. (vladi-private-islands.de)

- Pre-screen regulatory risk — ask seller/broker for FEMA zone, state coastal program status, and known permit history. If the island is in a VE/A flood zone or on protected habitat, that is a major variable. (FEMA)

- Make a conditional offer with sufficient inspection period (title, survey, environmental, and marine inspections). Include a contingency to review permitting feasibility for your intended project.

- Line up specialists early — marine surveyor, coastal engineer, geotech, environmental consultant, experienced title attorney.

- Plan for operating costs — insurance, staff, maintenance, utilities, dredging. Budget conservatively for the first three years.

- Close and implement resilience plan — elevating structures, nature-based shore protection, formal emergency plans. (NOAA Coastal Management)

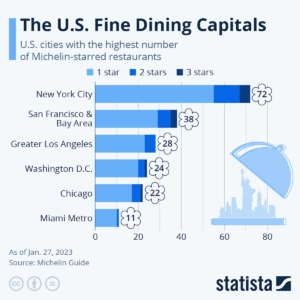

Top 5 U.S. Cities with the Most Michelin-Starred Restaurants 2025

15) Closing thoughts

Buying a private island in the United States is an emotionally powerful and logistically complex undertaking. The expertise you need includes coastal permitting and environmental compliance, the experience you need is in dealing with marine infrastructure and insurance markets, the authoritativeness comes from working with specialist brokers and trusted government mapping (FEMA/NOAA), and trustworthiness requires transparent due diligence and honest budgeting.

Read this also: Luxury Homes and Mansions in Colorado Springs: Ultimate Guide to Prices, Neighborhoods, Billionaire-Owned Estates, and Real Estate Trends 2025

![American Express Black Card (Centurion) – Requirements, Fees, Benefits, Credit Limit, and How to Get Invited [2025 Guide] American Express Black Card (Centurion) – Requirements, Fees, Benefits, Credit Limit, and How to Get Invited [2025 Guide]](https://luxuryamerica.us/wp-content/uploads/2025/09/American-Express-Centurion-Black-Card-American-express-black-card-300x194.avif)

Leave a Reply